I put together a “DTC Metrics Playbook” for my teams to help bridge the gap between everyday tasks and our ultimate goals. It explains the metrics we track / should track, why we track them, and how we can move forward based on that data. I’ve included an abbreviated version below, in case helpful to anyone reading.

Every decision —in growth, product, CX, merch, or operations—shapes our core metrics. Understanding these isn't just for finance; it’s essential for smarter decisions and aligned teams.

This playbook clarifies each metric, why it matters, how to use it, and how it connects to our growth. Used effectively, these metrics:

Guide confident, informed spending

Highlight actionable growth levers

Provide early warning signs

Create a shared language across teams

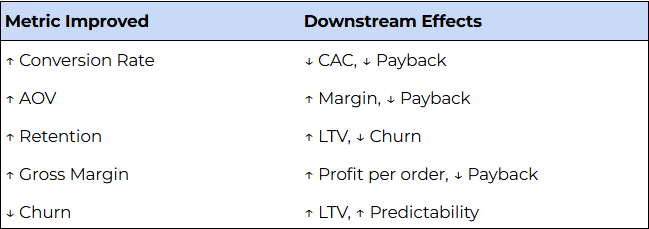

Small optimizations (like improving conversion or AOV) can significantly impact CAC, payback, LTV, and retention. This document should be a compass for making performance-driven, customer-first decisions.

The Member Journey: Funnel View

Customers move through a funnel from their first click to ongoing subscription. Each funnel step influences conversions, costs, and future customer behavior.

The key funnel stages:

Ad Impression → Click

Checkout → First Order

First Experience → Repeat Order

Retention / Churn

Understanding and optimizing each step of this journey is foundational.

Product Metrics

Traffic

Measures sessions to our site

Split between first-time visitors and returning users

Helps us diagnose acquisition efficiency and awareness at the top of funnel

Conversion Rate

% of people who complete checkout ÷ unique visitors

Key driver of CAC

PLP / PDP / Collection Pages

PLP = Product Listing Page

PDP = Product Detail Page

Collection PDPs drive conversions by bundling discovery with decision

Reactivation, Churn and Zombie Metrics

Reactivation

Churned users who return via email or reactivation campaigns

Signals brand affinity even among churned users

Zombie Subscribers

Subscribers with no order in X+ weeks

May have changed preferences

Reactivation via targeted nudges

Marketing Metrics

Spend by Channel

Definition: Total marketing dollars spent, broken down by channel (Meta, Google, Affiliate, Email, etc.)

Why it matters:

Spend efficiency varies greatly by channel. Helps us reallocate dollars based on CAC, and LTV impact

Impressions, Clicks, CTR

Definition: Standard top-of-funnel performance metrics

Impressions: How many times our ads are shown

Clicks: How many times users click

CTR (Click-through Rate):

Clicks / Impressions

Why it matters:

CTR is an early signal of creative and audience resonance. A high CTR + low conversion = landing page problem. Low CTR = creative or audience issue

New Customers by Channel

Definition: Count of net-new paying users, broken down by source

Why it matters:

Allows us to see where our best customers are coming from — not just quantity, but quality (via LTV)

Channel Performance

Definition: Breakout of ad performance by creative (video, static, carousel)

Why it matters:

We scale what performs and cut what doesn’t

Customer Acquisition Cost (CAC)

Definition: The average cost to acquire a new paying customer.

Formula:

CAC = Total paid marketing spend / New customers acquired

What it includes: Paid media (Meta, Google, affiliate), agency fees, creative costs

Why it matters:

CAC is the foundation of our unit economics. It tells us how efficient our growth spend is.

But CAC isn’t fixed — it's affected by:

Conversion rate

Speed and clarity of onboarding

Payment options (e.g., adding Apple Pay can reduce CAC by increasing conversion)

Creative performance and audience quality

Hypothetical Example:

If we improve checkout conversion from 1% → 1.5%, CAC drops ~33%, assuming same spend. That’s a massive gain with zero extra dollars spent.

CAC at 1% Conversion Rate

Customers acquired = 1,000,000 × 1.0% = 10,000 | CAC = $100,000 / 10,000 = $10.00

CAC at 1.5% Conversion Rate

Customers acquired = 1,000,000 × 1.5% = 15,000 | CAC = $100,000 / 15,000 = $6.67

= ($10.00 - $6.67) / $10.00 = 33.3% decrease

Lifetime Value (LTV)

Definition: The total contribution profit expected from a customer over their lifecycle.

Formula:

LTV = Gross margin per order × Expected # of orders within a time period

What affects LTV:

Retention

AOV

Margin

Upsells / repeat purchases

Why it matters:

LTV tells us how valuable a customer is. It justifies how much we can spend to acquire them — and how long we’re willing to wait for payback.

LTV / CAC Ratio

Definition: The ratio of how much value we get from a customer vs. what we spend to acquire them.

Formula:

LTV / CAC (excl. Promos)

Benchmarks:

1.0x = break-even

1.5x = acceptable

3.0x+ = strong performance

Why it matters:

This tells us whether our acquisition strategy is sustainable. Higher CAC can be fine if LTV grows too — but if CAC rises and LTV falls, it is not a great sign

Example:

If CAC jumps from $40 → $55 but AOV and retention are unchanged, our LTV/CAC drops and payback slows — making us less capital efficient.

Payback Period

Definition: The number of months it takes for a customer to “earn back” their CAC through contribution margin.

Why it matters:

Payback tells us how fast we can reinvest growth dollars. If CAC is $50 and we generate $10 in CM per month, payback = 5 months. Shorter payback = faster growth cycles.

How to improve it:

Increase AOV

Improve early retention

Boost gross margin

Lower CAC

Retention Rate

Definition: The % of customers in a cohort who remain active (paying) each month

Why it matters:

Retention is the strongest signal of product-market fit. If people stay subscribed, it means we’re delivering value

Average Order Value (AOV)

Definition: Total revenue ÷ number of orders

Why it matters:

Higher AOV means we make more per shipment, which shortens payback and boosts margin.

How to grow AOV:

Bundle products

Offer upsells at checkout

Raise price (only if value supports it)

Caveat:

Higher AOV isn’t always better. If it reduces order frequency or retention, net impact on LTV may be neutral or negative.

Gross Margin

Definition: Profit per order after subtracting variable costs.

Why it matters:

GM is what pays for fixed costs — and what makes growth profitable

Hypothetical Example:

If your AOV is $40 and GM is 35%, we earn $14 per shipment. If CAC is $110, we need 8 shipments to break even (assuming stable margin + retention).

Churn Rate

Definition: (Subs that unsubscribed / subscribers in prior period)

Measures how many customers stop subscribing each month

Why it matters:

Churn erodes LTV and signals a value gap. High churn → short customer lifecycles → fragile unit economics

Summary

Final Thoughts

Winning in DTC is about relentlessly improving the fundamentals, aligning teams around shared goals, and making every decision data-informed. This playbook gives us the tools and language to do just that.

By understanding how each lever — from conversion to retention to upsell behavior — flows through our metrics, we unlock smarter growth, faster learning loops, and better customer experiences.